Question 56

When the level of market interest rates is anticipated to fall (select the best answer):

Question 57

When the market is in backwardation, the roll yield will be ______ for a hedger.

Question 58

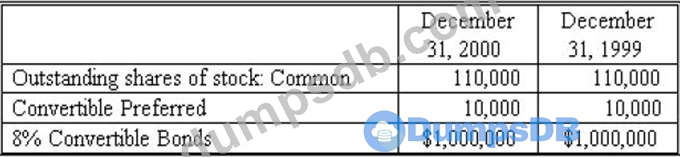

Advantage Corp.'s capital structure was as follows:

During 2000,

Advantage paid dividends of $3 per share on its preferred stock. The preferred shares are convertible into

2 0,000 shares of common stock. The 8 percent bonds are convertible into 30,000 shares of common stock. Net income for 2000 was $850,000. Assume the income tax rate is 30 percent. The basic earnings per share for 2000 is:

Question 59

In terms of CFA Institute's Standards of Professional Conduct when dealing with the procedures for compliance per Standard IV A (Loyalty), which of the following are activities that might constitute a violation of the duty to the employer:

I). misappropriation of trade secrets.

II). conspiracy to bring about the resignation of other employees.

III). misuse of confidential information.

IV). misappropriation of client lists.

Question 60

Taylor Corporation purchased a new asset for $80,000. The asset had an estimated lifeof 5 years and an estimated salvage value of $20,000. What is the depreciation expense in the second year if the company uses the double-declining balance method?