Question 56

---

A manager at a large gold mining company is trying to determine how a series of recent events will affect the future of his industry.

The following events occur simultaneously:

Flooding damages several gold mines in a region.

The price of platinum, a substitute for gold, increases.

A new government policy mandates an increased wage rate for mine workers.

What should the manager expect regarding the new equilibrium price and quantity for gold?

Question 57

A serious drought has created a shortage of food across the country. In an attempt to maximize profits, one grocery store decided to auction off its limited supply of food. Which of the following scenarios is the MOST likely to occur in this situation?

Question 58

What is the set of accounting standards most commonly used by companies outside the US?

Question 59

Which of the following options is an example of revenue?

Question 60

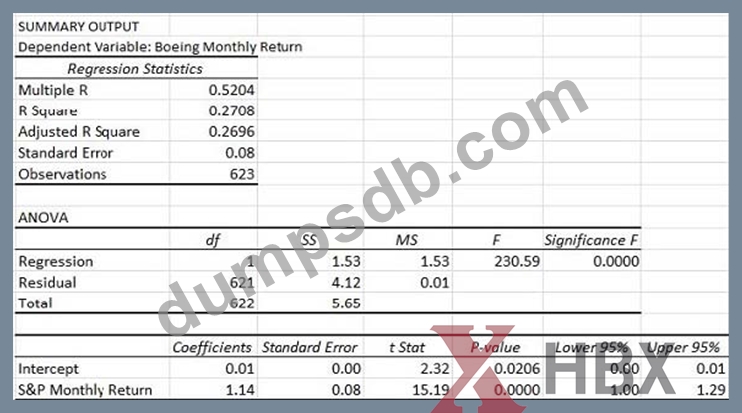

In finance, beta is a measure of the systematic risk of a security in comparison to the market as a whole. Beta can be found by running a regression analysis of the monthly returns of the security versus the monthly returns of the general market. The regression output table below shows the relationship between Boeing's monthly returns and the monthly returns of the Standard and Poor's 500 (S&P 500) which is a stock market index of 500 large companies.

If beta is the average change in Boeing's monthly returns as the monthly returns of the S&P 500 increase by one, what is Boeing's beta?