Question 61

What is the PRIMARY issue that management needs to consider when determining capital structure?

Question 62

An employer wishing to reduce operating income volatility would MOST LIKELY offer what type of retirement option to its employees?

Question 63

A cash manager at a U.S. retailer forecasts a positive collected cash position for the end of the current day. The company has an overdraft facility at 10%, a separate investment account earning 8% before taxes, an earnings credit rate of 8% and an outstanding single payment note at 9.5% maturing in 1 week. This month's bank service fees are expected to exceed the earnings credit. Which of the following options would be the MOST economically positive for the company?

Question 64

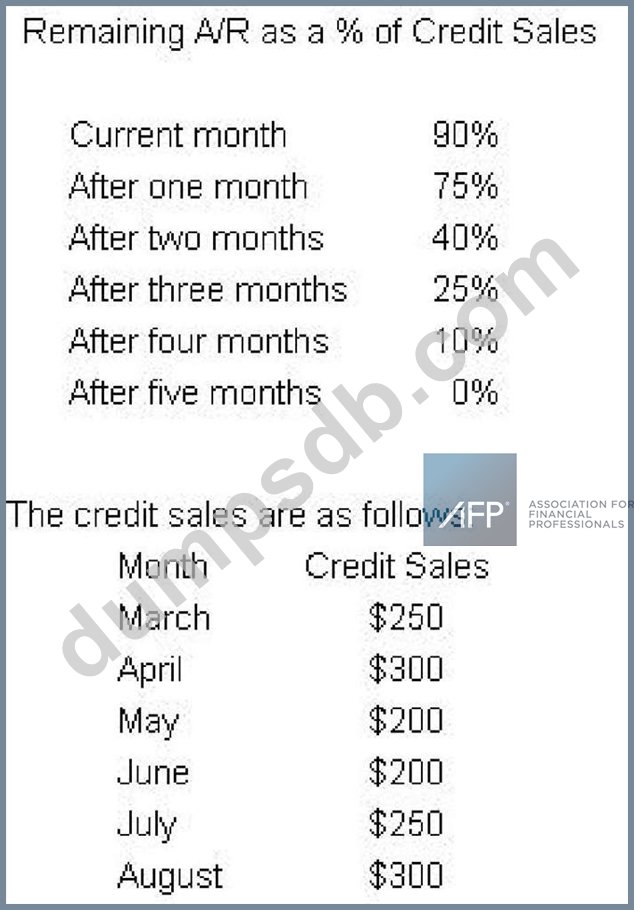

A company's accounts receivable balance pattern is shown in the first table. Credit sales are shown in the second table.

What is the cash inflow for the month of August?

Question 65

A small for-profit, start-up company is designing a retirement plan with the goal of minimizing costs and operating income volatility while providing a qualified retirement savings vehicle. Which of the following would be the BEST choice?