Question 76

JKL Company has been successful in shortening the time associated with its mail float, processing float and availability float. JKL Company will experience which of the following as a result of these improvements?

Question 77

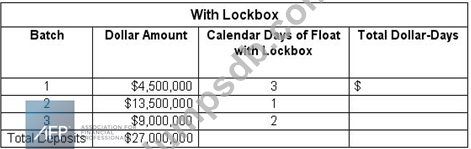

An analyst at XYZ Company was assigned with determining if the company should start to use a lockbox provider for its retail payments. The analyst determined that the company's annual sales of $324,000,000 were recorded evenly throughout the year. The Company receives 30,000 checks annually. Total dollar-days float without the lockbox is $76,500,000 and the annual opportunity cost is 5.5%; assume 30-day month. The industry's average

opportunity cost is 6.0%. Using the information in the table,what would be the net effect of

using the lockbox?

Question 78

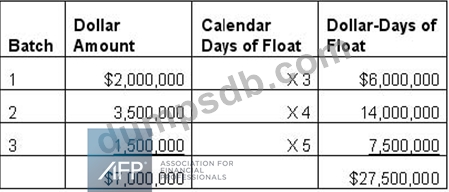

There are 31 calendar days in the month, and the opportunity cost of funds is 9%.

What is the annual cost of float for the batches listed?

Question 79

BEA Company has determined its breakeven dollar amount for concentrating remote funds is $550.00. BEA Company has a daily earnings rate of 6% and gains one day of

accelerated funds. If a wire costs BEA $35.00 dollars, what is the cost of an electronic funds transfer for BEA Company?

Question 80

Which of the following is a purpose of the Check 21 Act?