Question 96

A company can dispute any check alterations within how many days after the bank statement has been sent?

Question 97

Senior management at ABC Company plans to make a large capital expenditure to bolster its infrastructure exactly one year from now. Their primary concern is to preserve the current capital position until the expected cash outlay. The majority of the cash at ABC Company is held in treasury notes, but management would like to also invest some of the money into corporate bonds and money market funds. Which investment objective BEST suits the needs of ABC Company?

Question 98

A retail lockbox system is characterized by which of the following?

I) An emphasis on processing cost

II) Detailed information on discounts taken

III) Small-dollar amounts per invoice

IV) Multiple invoices per payment

Question 99

Which one of the following is NOT a method used by a company to repurchase stock?

Question 100

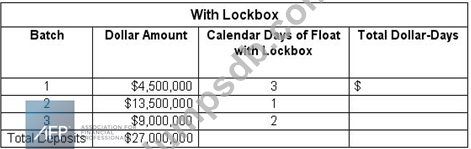

An analyst at XYZ Company was assigned with determining if the company should start to use a lockbox provider for its retail payments. The analyst determined that the company's annual sales of $324,000,000 were recorded evenly throughout the year. The Company receives 30,000 checks annually. Total dollar-days float without the lockbox is $76,500,000 and the annual opportunity cost is 5.5%; assume 30-day month. The industry's average opportunity cost is 6.0%. Using the information in the table,

what would be the net effect of using the lockbox?