Question 6

A company is based in the United States and has an operating subsidiary in Germany. With a stable U.S. dollar and a depreciating euro, the company's cash manager may elect to:

Question 7

A buyer receives an invoice from a supplier that offers discount terms of 3/10, net 60. What is the effective cost of discount?

Question 8

An L/C in favor of a U.S. exporter is issued by a bank in an emerging-market country, and it is confirmed by the exporter's bank. What risk is reduced for the U.S. exporter?

Question 9

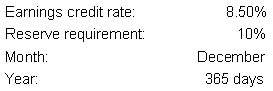

On the basis of the information above, what level of net collected balances is necessary to compensate a bank for $1.00 worth of services?

Question 10

Which cost benefit analysis technique uses the methodology to find where the present value of each project's cash inflows equals the present value of each project's outflows?