Question 11

Which of the following global cash concentration methods would be MOST appropriate for a company with operations in the United States, Germany, Mexico, and Japan?

Question 12

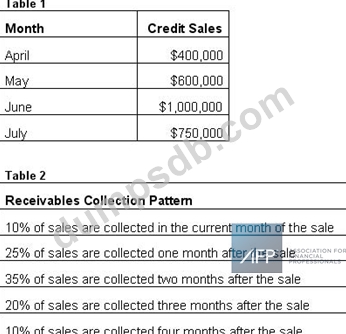

The company's monthly credit sales are in Table 1.

The company's receivables collection pattern is in Table 2. If this company's accounts receivable on March 31 is $0, what would the accounts receivable balance be at the end of July? Assume a 90-day quarter.

Question 13

A U.S. bank regularly transmits international payments to European based XYZ Bank. The payments flow through an intermediary bank. Recently regulators audited the intermediary bank and discovered the bank may be unknowingly facilitating illegal activities. What payment method was MOST LIKELY used?

Question 14

Which of the following credit terms would be MOST appropriate for a seasonal product that a manufacturer wants to sell to a retailer during the product's off-season?

Question 15

If a company has $126 million in debt at an average cost of 7% and $234 million in equity at a cost of 11%, what is its weighted average cost of capital, assuming a marginal tax rate of 35% and a risk-adjusted rate of 13%?