Question 51

Two competing companies sell very similar products that are manufactured in plants located near each other in the United States. Company A values inventory using last-in, first-out (LIFO) and uses accelerated depreciation for plant assets. Company B values inventory using first-in, first-out (FIFO) and uses straight-line depreciation. From this information, what conclusions can an analyst draw about the gross margin reported for the two companies?

Question 52

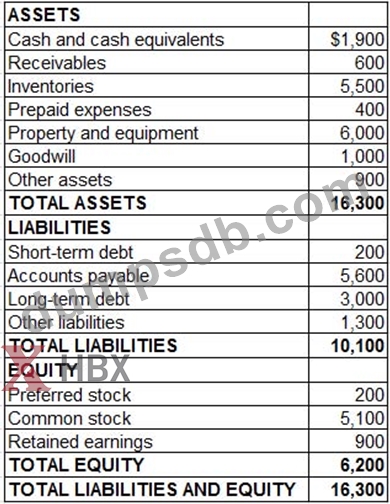

A company's Balance Sheet for the year ended Dec. 31, 2013 is as follows:

(In millions)

The company is MOST likely in which of the following industries?

Question 53

A restaurant that sells hamburgers is considering lowering prices to gain market share. The restaurant pays $3,000 a month for the building it occupies, and ingredients and labor cost $2.50 per hamburger. If the restaurant expects to sell 2,000 hamburgers a month, what is the minimum price it could charge?

Question 54

Which of the following options is an example of an expense?

Question 55

The graph below reflects which of the following situations in the market for apples?